“Earn well by doing well” - future investor slogan

Key moments:

•ESG rating history

•ESG rating methodology

•The role of ESG in investment assessment

•Development of responsible investment on the world stage in 2016-2018

Socially Responsible Investment (SRI) is an investment approach that seeks to incorporate environmental, social and management factors (ESG factors) in the investment decision-making process for better risk management as well as sustainable and long-term return on investment.

In other words, investing in ethically operating companies and voting in dollars, investors direct other companies in the market to the “right” path. Sounds like a win-win situation, right?

The fundamental goal of any investment is to make a profit. Not all industries, due to their activities (primarily the energy sector), are able to meet high standards for environmental factors. However, given the growing demands from the UN and other entities, the business of such companies is a time bomb.

A rational solution may be to adopt ESG factors as a risk assessment measure that helps to find promising investments. In particular, non-compliance with environmental factors in the future can entail significant expenses in the process of carrying out activities for the transition to environmentally friendly production, and violation of social factors is likely to become a source of serious public scandals, which will already result in material losses. By the way, according to a study by AQR asset management company, in 2018 the shares of companies with high ESG ratings were less volatile.

ESG rating history

A little excursion back into history: The Responsible Investment Association (RIA) was established in 2006 after several large institutional investors from 12 countries accepted the invitation from the UN Secretary General and developed six basic Principles for Responsible Investment. More over, it is worth noting that according to these principles, adhering to and disclosing information regarding the implementation of environmental, social and management principles is necessary not only for issuers, but also for investors themselves.

Back in 2018, the Fitch group of companies announced the signing of the UN Responsible Investment Principles, and in January 2019, the international rating agency Fitch Ratings developed a scoring system for assessing the impact of ESG factors on credit ratings - ESG Relevance Scores, which will be used to evaluate ratings for all asset classes assigned by the agency. Given the growing importance, we can safely assume that Fitch is the first, but certainly not the last international agency that developed and implemented a similar system. In 2019, about 2 thousand companies are members of the organization. Currently ESG is also appropriated by RAEX Europe (Rating-Agentur Expert RA GmbH), which is a division of the international RAEX group and a number of other lesser-known agencies in Russia and Europe. Also on the development of the integration of ESG factors ininvestment processes is the growth in the issuance of non-financial reporting guidelines for issuing companies. In 2009, the Sustainable Stock ExchangeInitiative was launched.

What documents regulate and evaluate ESG factors?

ESG rating Methodology

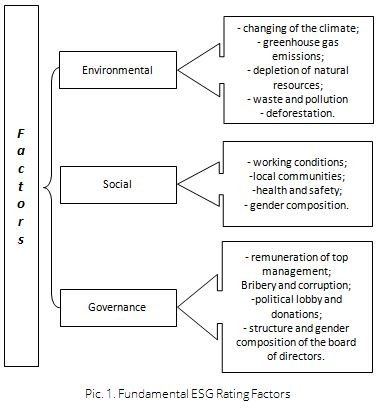

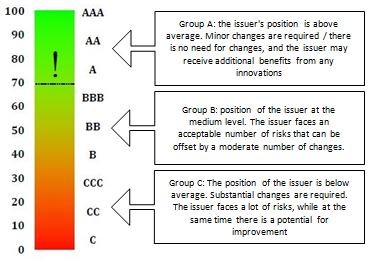

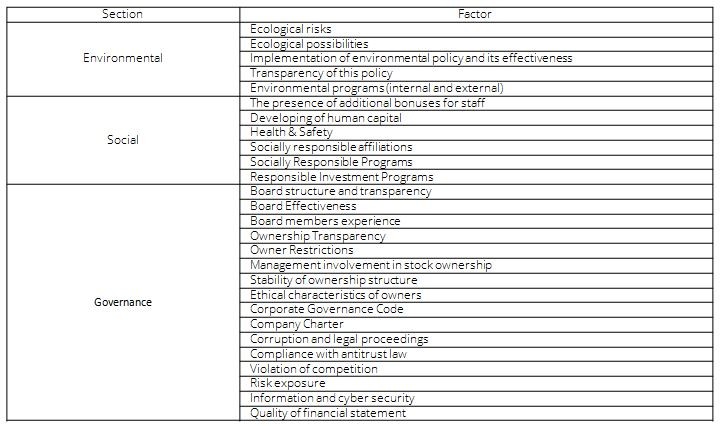

The rating is assigned in accordance with a specific letter and number scale of the agency and allows you to compare the rated objects on this scale. In the process of assigning the final ESG rating, the agency evaluates each of the three sections E (environmental friendliness), S (social factors) and G (corporate governance), the result of which is an average indicator. The result also displays the level of resolution of the corresponding problems.

Sources of information which allow to analyze the level of awareness of doing business and further calculation of the rating are directly the rating object itself and the information provided by it, the government, the media and other available sources.

The role of ESG in investment assessment

The level of responsible investment, which is reflected in the high ESG rating, also has a direct impact on the performance of companies:

• higher return on bonds (less chance of default);

• decrease in the cost of raising capital;

• better operating results and, as a result, financial performance;

• less volatility of investment instruments.

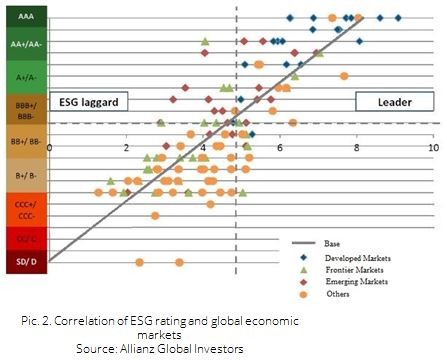

As a clear example of how the ESG rating correlates with the financial performance of companies a graph presents how companies in developed markets (USA, EU) with the highest ESG ratings also hold the higher credit ratings assigned by of international agencies.

Is it worth clarifying that having a rating of an international agency like Fitch or Moody’s, and even a higher rating implies good financial performance and, on the whole, a fairly stable company?

Development of responsible investment on the world stage in 2016-2018

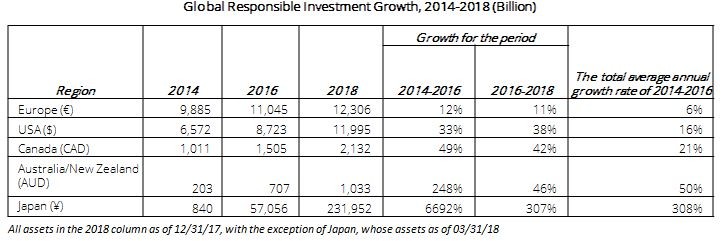

The growth and relevance of responsible investment is confirmed by the statistics of the Global Sustainable Alliance (GSIA), which has been preparing a report on the dynamics of market expansion for the last 2 years in a row. Undoubtedly, the leaders of responsible investments are the USA and Europe, where they especially focus on human rights in various aspects and environmental protection, respectively. But undoubtedly optimistic fact is the growth rate of such investments in other countries.

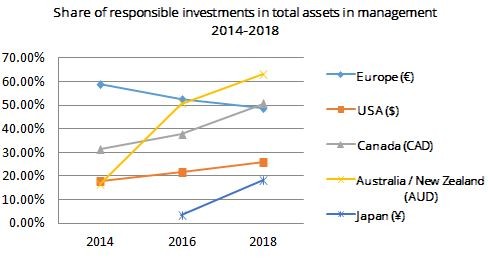

Globally, responsible investment assets in five major markets at the beginning of 2018 amounted to $ 30.7 trillion. In all regions except Europe, their share has grown, but in Europe the responsible investment market can be safely considered developed. Responsible investing currently provides a significant share of professionally managed assets in each region, ranging from 18% in Japan to 63% in Australia and New Zealand, the latter are also the three fastest growing regions in this investment segment.

Despite a decrease in the share of responsible investments in total assets in Europe, it is this region that continues to maintain leadership in the total volume of sustainable investments. The share of responsible investments made in Europe in the global fund is 46%.

Noteworthy and clearly optimistic is the fact that in 2018 versus 2016, the share of private sustainable investments relative to institutional ones significantly increased to 25% from 20%. Order and awareness begins with the individual.

Instrumentally 51% of investments are in shares, 36% - in bonds. Despite the fact that the leading position is clearly not in fixed income instruments, green bonds are becoming more and more relevant.

Green bonds are a special type of bonds issued for the purpose of implementing programs and projects aimed at developing a green economy. Subsequently, as a rule, a conclusion of external expert organizations (second opinion) is necessary, which reflects the targeted use of the proceeds from the issuance of green bonds and their compliance with the Principles of green organizations (developed by the International Association of Capital Markets).

The theme of the green economy is gradually gaining new horizons. In China and Japan there are government measures to support green bonds in the form of 2% subsidies; in the USA, the issue of tax-free green bonds by federal development corporations and municipalities in 2018 increased by 120% compared to the previous year; The European Commission is considering the possibility of introducing tax benefits for green bonds at the level of each individual state (2.5% tax credit has already been introduced in the Netherlands).

Is it worth considering ESG rating as a fundamental factor for making a decision on investing in a particular instrument? Probably, the time has not yet come to take it as a base one, since the market is only developing. However, it is safe to say that sustainable investment is the future. Not only such an abstract factor as an increase in public awareness of environmental protection, corporate ethics or social security, but also, first of all, the regulatory requirements of the European Union and other organizations on bringing enterprises' activities in line with certain norms (in particular, the EU’s goals on decarbonization of energy enterprises) are incentives to give priority to companies with high ESG ratings.

Olesia Shemet

Financial analyst, Macte Invest

Back