IPO: what should investor know?

Key moments:

•IPO procedure

•Successful & failed IPOs: what's thesecret?

•IPO 2019: where are the pitfalls?

IPO procedure

The IPO wave, which covered the stock market in 2018, is now actively gaining momentum, and numerous unicorn names are one the IPO horizon: Uber, Lyft, Zoom, Pinterest. How to recognize a company that, in its public status, will bring profit to the investor, and not regret?

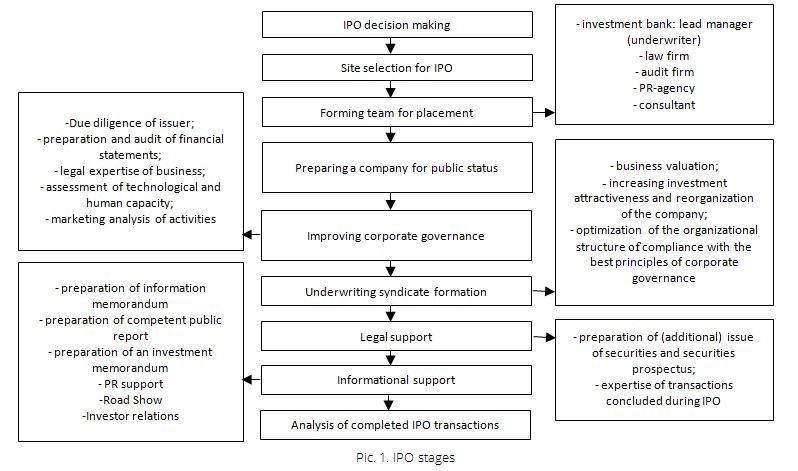

The success of an IPO directly depends on the level of its organization and the effectiveness of each stage, which are schematically presented below for the presentation of the process.

The company, the potential investor and the intermediary between them (the underwriter): they are all participants in the IPO process, their goals and functions are different. Directly the company itself undergoes IPO in order to attract long-term financial resources in the maximum amount and at minimum costs; the investor seeks to earn income in the future with minimal risk; the underwriter is a link, the main task of which is to determine the offer price of shares.

The underwriter decides not only to whom to set the lock-up period, but also to whom in principle to sell the shares. In the case of a large number of applications for participation in IPO, shares are sold to more priority investors. The probability of becoming a shareholder is directly proportional to the size of the submitted application. Underwriters also have the right to prioritize the purchase of a portion of the stock. In this case, in addition to payment for services for the preparation and maintenance of IPO, an additional source of profit may also be the difference between the stated price of the placement and the price at the time of the opening of the trading.

After the placement, the underwriter provides for some time, at the expense of its resources, the maintenance of the company's stock quotes at the proper level. Without this support, a liquid stock market of the company will not be created, interest in them will begin to fall, and after it quotes.

Successful & failed IPOs: what's the secret?

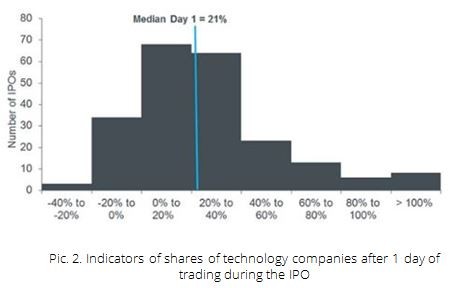

Investors are pinning their greatest hopes on technology stocks during an IPO, but it is their rapid growth that makes it difficult to predict the future price. A simple starting point is the analysis of the basic conditions. As a result of the analysis of technological IPOs conducted in the United States from 2010 to 2018, the average price increase on the first trading day was 21%.

At the same time, in 1 year of trading, the return on stocks is usually low, or even below 0. Especially the market responds to the end of the lock-up period and reporting output. Given the cost of an IPO, the majority of companies in the reporting periods show losses.

In other words, in the first year of going public, the decline in price is observed for 5-7 months, often 10 months and at the end of the first year.

So, using the example of an average technology company during an IPO in the United States, growth was observed on the first trading day, but the relative price for the remainder of the first year was negative.

Is it possible to choose criteria by which an IPO is conditionally considered successful or not? It is a mistake to judge its success only by the amount of funds raised. Raising capital is the initial goal of the company itself, while investors are more interested in its further growth. Thus, the key criteria by which it is worth judging the success of an IPO of a company are the amount of capital raised and by which border of the price corridor was placed; the stock price the next day and the long-term growth of securities (consider the growth of the company after 3 months of entering the market and at the end of the year). In other words, the value of the company's shares after acquiring the status of public company should increase, or at least remain steadily above the offeringprice.

Every year more and more companies want to gain a public status. The history of stock markets is rich not only with the facts of successful placement, but also with the company's further growth. The absolute record holder is the IPO of Chinese giant Alibaba, which not only attracted $ 25 billion, but later, havingovercome the above-described critical moments of the first year of public status, the company achieved stable growth. By the way, we can track these critical moments on the graph of other IPO record holders: Facebook ($ 16 billion, 2012 placement), Visa ($ 25 billion, 2008 placement), Telstra ($ 25 billion, 1997 placement). The fall in prices relative to placement at the moments of drawdown on average reaches 30%, in some cases, more than 50% (Facebook).

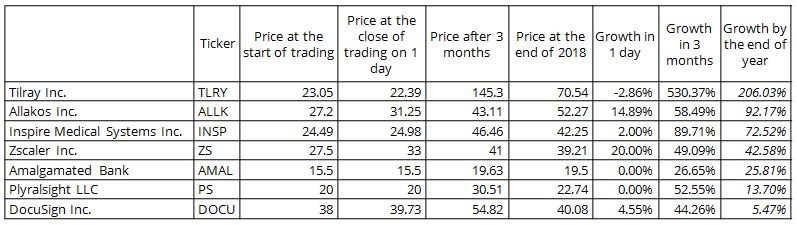

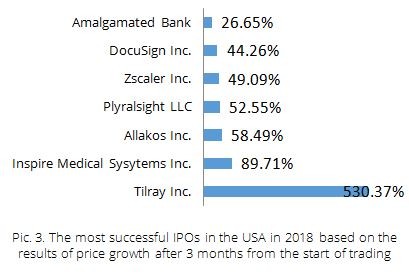

General trends in the development of companies after entering the market are characteristic even for the 90s, but it is more expedient to focus on times that are not so distant. Thus, in 2018, 217 (+ 52% y / y) initial public offerings were made on the American stock market, of which slightly less than a third showed an increase in prices from the start of trading by the end of the year. 144 placements, or 66.3% of the total number of IPOs, took place on NASDAQ, and, accordingly, 73 public offerings were recorded on the New York Stock Exchange NYSE. As a result of the analysis of public offerings conducted until September 2018 (for analyzing changes in quotes for at least 3 months), 58 companies showed an increase.

As you can see, the most successful IPOs were not of the most famous companies. At the same time, although the expected IPO of Spotify Technology SA (NYSE: SPOT) allowed the company to attract $9.2 billion, its financial year ended with a 31% fall in the share price.

The success of an IPO is a consequence of certain initial data. While it’s possible to spot successful IPOs after the event, it is much more difficult to prognoze them before the IPO has happened.

Of course, at the core of a successful IPO is the business idea, its relevance in the current moment and uniqueness, which allows the company to take its market share and claim the growth. All above companies are operating in the most promising sectors of the economy today: technology, medicine, the financial sector, and the cannabis market that just blew up last year.

However, a business is not an ephemeral idea, but also a material base, in other words, the assets and liabilities of a company, which allow it to carry out full-fledged activities. IPOs often promise revenue growth during the first years, which actually attracts investors. Although raising capital initially implies its growth, the company's profit is more important. And in this case, the above-mentioned successful companies are different in that they initially entered the market, if not with a profit in the balance sheet, then with a negative net debt. Why are balance indicators important? The market always responds to regular financial reporting. During the preparation and conduct of a public offering, the company incurs significant costs, which will be reflected even at least during the first year of publicity. Overhead costs for IPO can be up to 10-15% of the amount of capital raised. Positive net debt and accumulated losses will only aggravate the situation.

The next important point is to make sure, that the company’s profits grow at a faster pacethan its revenues. The generated profit will allow the company to offset the costs of IPO.

What is the conclusion? No matter how phenomenal a business idea is, no one has repealed the laws of capitalism: a company can only develop in terms of generating profits.

IPO 2019: where are the pitfalls?

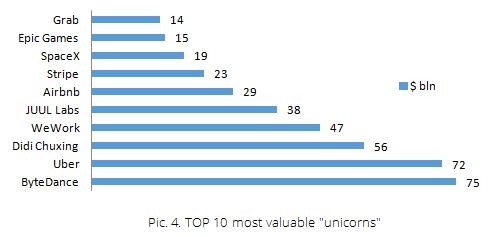

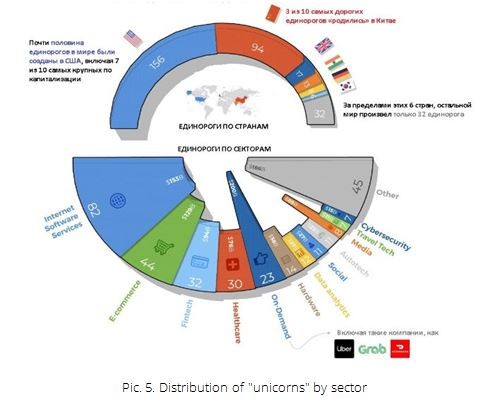

The year 2019 can rightly be considered the year of the IPO’s of the "unicorns", who hold the dominant market share, but at the same time carry on unprofitable activities. “Unicorns” are called start-ups worth as much as $ 1 billion. Recently, the total value of 326 unicorns in the world has reached $ 1.1 trillion.

Moreover, the 10 largest such startups value $ 388 billion, which is 36% of the value of all currently existing 326 "unicorns". This year Lyft, Pinterest, Uber and Zoom Video have already entered the public market, and the price of the latter has grown since that moment by 202% relative to the price of placement.

The two most common sectors of "unicorns" are Internet-based software services and electronic commerce, and in the presence of huge revenues, most companies in the financial result article show significant losses. In 2018-2019, 15 unicorns have already entered the market, of which only Zoom and Tencent Music were profitable.

In other words, combining all 15 such companies, we get one huge unprofitable "unicorn" with annual revenues of more than $ 25 billion and a loss of $ 6 billion.

How appropriate is it to invest in a loss-making company? An important role is played by the economic sector. So in the fast-growing technology sector, it is fair to assume that it is easier for a dominant company to reach a break-even point and generate profits in comparison to an average company. However, before making a decision we recommend to pay attentionto the following points:

1.Economy sector and market share;

2.IPO date: if placed in the run-up to the reporting period, itis obvious that, as a result of substantial costs, the financial indicatorswill be much worse than those presented in the prospectus. The market willrespond immediately;

3. The fact of the previous "failure" IPO of a competitor (remember Lyft and Uber);

4. Financial performance: the company must generate a positive cash flow that can ensure the financial stability of the company (we pay attention to the ratios of free cash-flow and net debt) and further profit. Moreover, in case of unprofitable activities at this stage, it is important to understand: the company is going public in order to expand business or survive?

5. Assess the strengths and weaknesses of the company that shape its competitiveness;

6. Macroeconomic factors of the issuer's country.

Of course, each individual case deserves an individual assessment approach and the key points may not be limited to the five points described above. However, one should not exclude such an investment opportunity, which, as history shows, can multiply the capital.

Risk-weighted investment - reasonable investment.

Olesia Shemet

Financial analyst, Macte Invest

Back