Outlook 2018/2019

Dear reader,

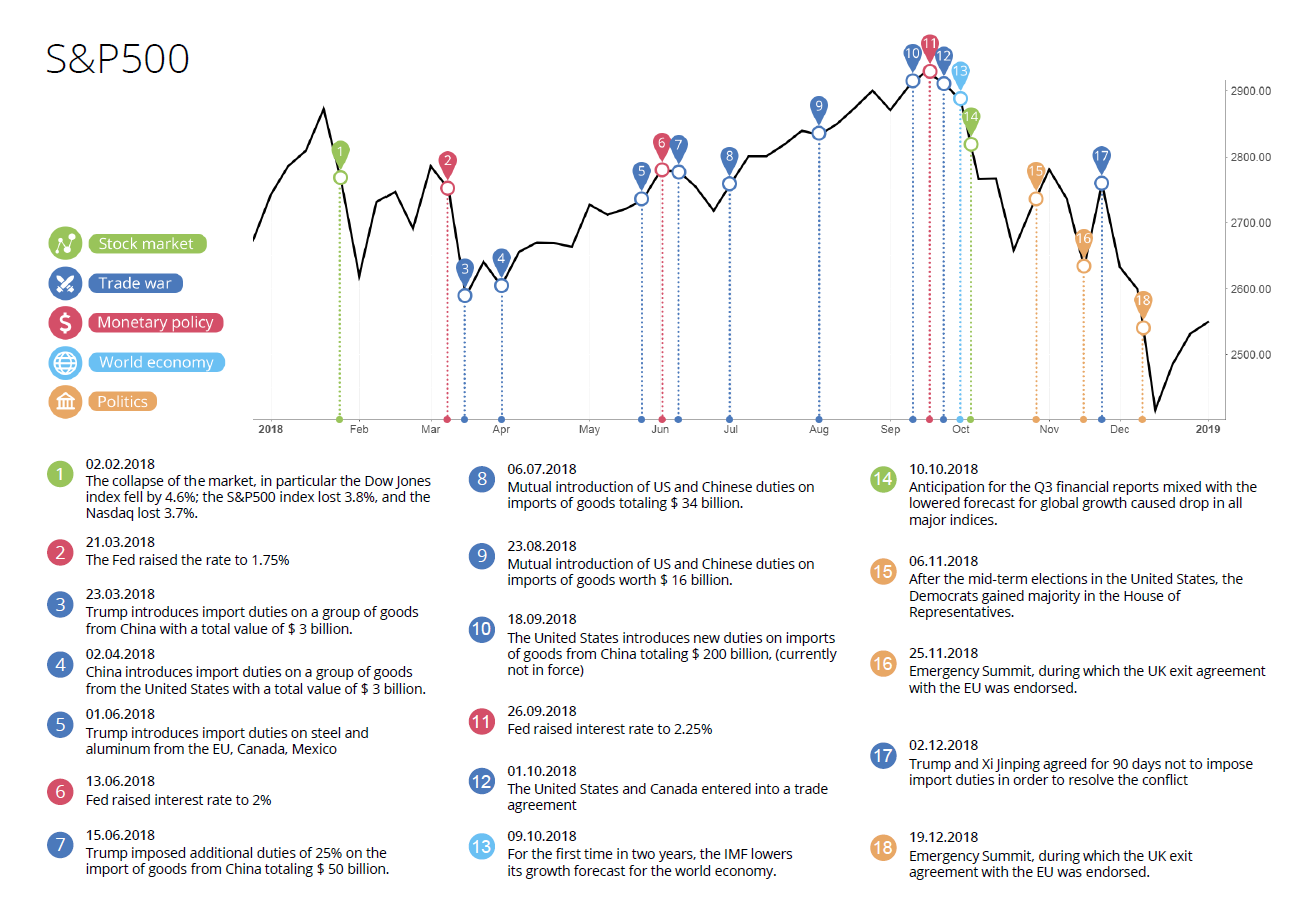

Another year has approached its festive closing. If looking back to the events taking place in 2018, financial markets, as well as our company, has experienced an eventful year. World markets showed mixed and often confusing signals throughout the year. The US economy grew by 3.5% in the third quarter of 2018 marking the strongest expansion since 2014, US unemployment rate reached 3.7% in September – the lowest level since 1969 and the stock market managed to reach record highs not 1, not 5, but 15 times with the latest record high close on October 3rd. As a result, we celebrated the longest bull market recorded in history on August 22nd.

Meanwhile, the same stock market experienced a rather harsh drop, especially during the last month of 2018. S&P500 closed Friday, December 21st, 16% down since the beginning of the month (for a comparison – S&P500 dropped 14.5% in December 1931). Meanwhile, Dow closed the same day -15.5% since the beginning of the month (Dow dropped 17% in December 1931). It is worth mentioning that December is typically seen as the best month for the market. Interestingly, the same day marked a 20.02% drop since the latest record high on October 3rd and officially entering a bear market.

We are extremely excited to act as an eyewitness to the fourth industrial revolution, which has a potential to revolutionize the economic growth and the corporate sustainability to the levels that are hard to imagine. You can see this in our investing preferences – from virtual reality and artificial intelligence to blockchain and self-driving cars. Although these stocks experienced a rather harsh ending of 2018, we are still strong believers in frontier technologies and the advancement of robotization and consider the current drop in the stock prices of such companies as a great opportunity to invest in a better future.

In times like these, it is extremely important to keep calm and even more important – to have a clear plan of action. In Macte Invest, we always strive to combine these two things in addition to being well informed about world events.

Year 2018 brought us not only volatile investment market, but also various important corporate milestones. The development of Macte Invest trading and accounting platforms were completed allowing our clients to start using them and take advantage of a set of user-friendly and valuable features. Meanwhile, another bond issue was organized with our international partners.

We are certain that 2019 will bring us numerous exciting investment opportunities , but only the most skilled professionals will be able to take advantage of them in a year that promises to be as challenging (if not more) as the previous one. We wish you to reach all your determined goals and success in investing!

Truly yours,

Macte Invest team

Macte Invest strategies

In the second half of 2018, Macte Invest analysts developed and proposed 7 investment proposals for stocks (with an aim to preserve the client’s capital or hedge their positions in already made investments). At the time of analyzing these proposals, all companies had a tendency to grow, which could provide the investor with a profit of more than 10%. The emphasis in drafting proposals was on the technology sector, as non-cyclical and fastest growing in 2018. Due to the strong market volatility especially by the end of 2018, all strategies include hedging with PUT options as part of risk management. The collapse of the market in October and December 2018 led to a loss in share prices of up to 30%, in some cases even up to 80%. It is worth noting that for all options in the strategies, the expiration date is not earlier than Q2 of 2019. According to analysts, the market has prospects to compensate for the losses of December 2018 and restore growth in 2019.

Below strategies have experienced limited losses. But if we compare the strategy results with the overall market or with the same stocks if our investors had purchased them without hedging, we can see that losses are considerably smaller for 6 out of 7 strategies. Only the companies operating in Gold production would have experienced higher profits when not hedged with respective options.

We have offered numerous investment opportunities in such bonds as EUR, USD, CNY, as well as high grade and high yield bonds, so each of the investor can find the most suitable investment opportunities for them. Macte Invest bond universe has been prepared in a separate document.

Perspectives for 2019

Sectors

Year 2019 has started on the verge of recession for the global economy. And also if it could be delayed until 2020-2021 according to optimistic forecasts, the slowdown in the economy is already an actual problem. In such conditions, it is better to pay attention to sectors of the economy that are not highly sensitive to the fluctuations of the economic cycles, such as communications, healthcare and other basic necessities. The health sector was marked in 2018 by a large number of joint projects of companies in order to achieve the best results in gene, cancer and other therapies using the latest technologies. Meanwhile, healthcare companies will face a steep drug patent expiry cycle over the following years, which generally leads to a decrease in drug prices and subsequently – shareholders’ profits. Controversies over US healthcare reform are both a constraint on the stock prices of companies in the sector and their risk increase.

Due to a rather strong decline during the last months of 2018, the information technology and communications sectors are currently among the most undervalued and able to show growth in 2019. This will be promoted by the development of new products, the development of 5G technology and streaming. Cyclical industries (energy, industrial production, financial sector, real estate) are most susceptible to business cycles and may experience a decline in 2019. In particular, the uncertainty of the financial sector is intensified by FRS policies, and power is under pressure situation in the oil market. The materials sector against the background of a strong correction looks too underestimated and has a good perspectives in future. However, the negative impact of trade wars and a strong US Dollar is still relevant. By the way, within this sector gold mining companies may become promising if the price of gold continues to rise.

It is also worth noting US Treasury bonds, which in 2019 against the background of increased investor interest in defensive assets, are expected to continue to decline in yield, but if the stock market recovers and the FRS softens, the situation may change.

FX & Commodities

In 2019, the market is showing signs of being less volatile, which, combined with such factors as the continued rate hike by the FRS, the growth of the US economy (albeit slowed down), and instability in the EU will help strengthen the US Dollar. In turn, the weakening of the currencies of developing countries is likely to continue in 2019 in the context of tightening the policies of the main financial regulators of the US and the EU. The highest growth potential against the US Dollar holds Polish Zloty (+ 7.41%), Colombian Peso (+ 7.36%), Czech Koruna (+ 7.13%). A revival of the gold market is possible thanks to a threat of approaching economic crisis, and an exit from the long correction period can be foreseen for platinum. At the same time, despite the rapid growth of palladium in 2018, due to the excess of demand over supply, this metal will probably retain its growth in the first half of 2019. The trend may change if the plan is fulfilled by Norilsk Nickel, the main producer in the world of palladium, to increase production.

S&P500

The main risks in 2019 are still a slowdown in the US economic growth, a trade conflict between the US and China, a rise in the FRS's key rate, instability of the UK economy due to Brexit as well as increasing political instability in Germany, which is the leading economy in the EU. Meanwhile, a balancing factor is that, according to Jerome Powell, Chair of the Federal Reserve, the key rate was close to its neutral level, meaning that its increase in 2019 will be less significant (if any) compared to 2018. It is also worth noting that this may lead to less significant volatility in the market. The threat of a decline in the purchasing power of the population in the US and rising inflation in the market remain relevant, however, a recovery of the bullish trend in the stock market can be predicted further this year.

S&P500 is expected to fluctuate in the range of 2,700-2,950 points. With an optimistic forecast, the S&P500 target may reach 2,950 points, while in waiting for a recession in the US economy at the end of 2019–2020, it is recommended to pay attention to risk hedging instruments.

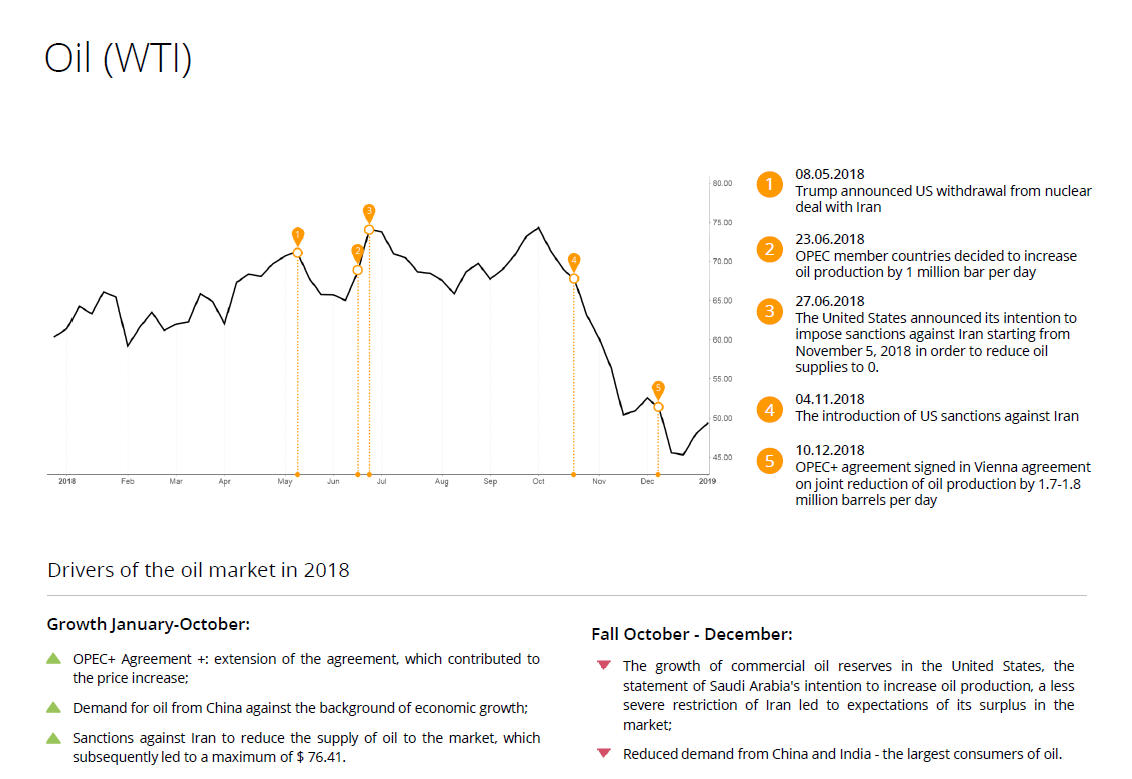

Oil

The current price for WTI of 45 USD per barrel is quite low, breaking the first level of support at a price of 57 USD per barrel. In the future, it is possible to reduce the price to the second support level (35 USD per barrel) With a possible further increase to 70 USD per barrel. At the same time, it is difficult to predict price movements in the oil market due to many factors.

Most Expected IPOs

In 2019, it is expected that IPOs of large companies will continue to grow. Also if the Chinese market maintains a weak result trend due to the risk of continued trade war, then the placement of such large companies as Lyft and Uber are promising and largely awaited in the market.

Disclaimer

Investments in products specified in this document may not be suitable for all investors. We remind you that the investor might not be able to return the invested amount. Macte Invest did not study the suitability of this investment to suit your individual needs and your risk tolerance. The content of this document is provided for information purposes only and is not an advertisement for securities and other financial instruments and/or financial services. This document does not express the intention of the company to provide investment adviser services, does not contain assurances that the financial instruments, products or services described in it meet the requirements of any of the addressees / users of this document, other persons who for whatever reason have received access to this document.

Any information presented in this document is subject to change at any time without prior notice. This document provides forward-looking statements. Forward-looking statements are not based on actual circumstances and include statements of opinion or current expectations. Thus, prices, payout sizes and other indicators appearing in this document are only indicative and can not be considered a guarantee. You must make your own risk assessment, not relying solely on the information with which you have been acquainted. This document is confidential and no part of it can be transferred or otherwise communicated to a third party (except for your external consultants, provided they have accepted similar confidentiality terms) without the prior written consent of the company.

Back