George Soros warns of the risk of a global financial crisis in Europe!

Do we believe in the word or analyze the situation?

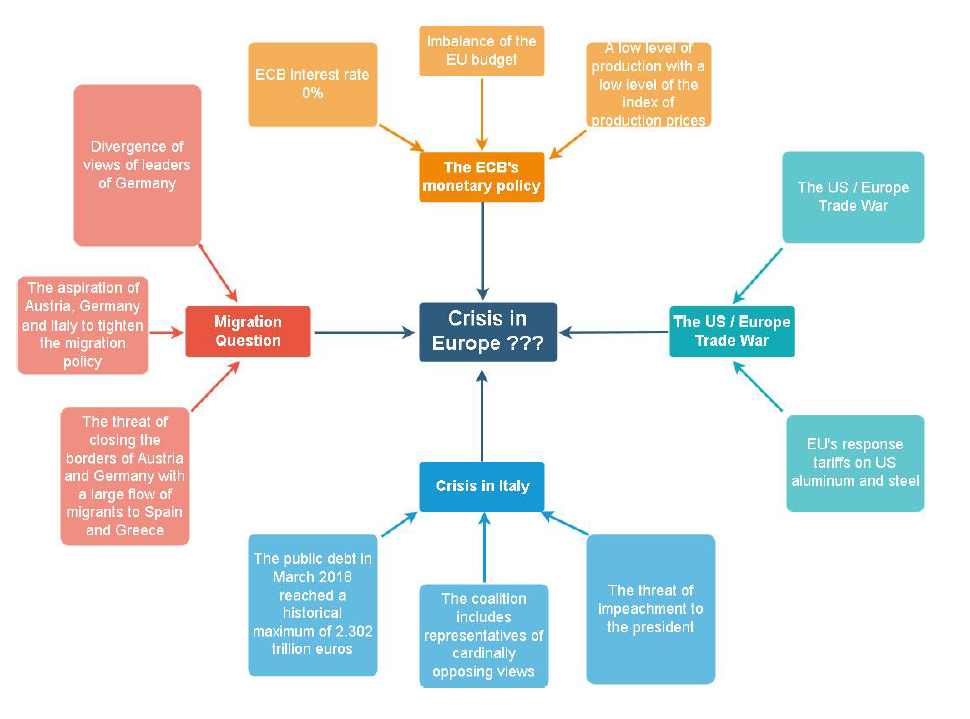

Recently, more and more analysts have expressed their concerns about the global financial crisis in Europe. A well-known American investor and financier, George Soros, insists that such a situation is inevitable, it's just a matter of time. The reasons are indeed significant: the strengthening of the dollar against the single European currency, the outflow of capital from emerging markets, as well as the political differences of the participating countries in the migration issue. As a "control shot," I would add a crisis in Italy. I propose to take a closer look at the risk factors and the strength of their influence, in order not to believe in the word of even such an authoritative person, but to have an idea of the overall picture and the vision of the consequences.

To form your own insight about the situation, I propose to consider each of the factors consistently.

Factors affecting the crisis in Europe

The Monetary Policy of the ECB

What is the first thing associated with the European Union? – A single currency. In 2012, ECB President Mario Draghi promised to do everything possible to keep the euro. This created a ground for a sharp decline in the government bond yields in the euro area until the middle of 2016. The yield spread between the Italian and German bonds has narrowed considerably, in fact, just as between the Spanish and German bonds.

The situation began to change significantly already in 2018 upon the developing crisis. The soft monetary policy of Draghi also causes some confusion: the rates do not change, loans are getting cheaper, but the inflation in Europe reached the planned 2% in February 2017 – and only thanks to energy prices.

Yes, Draghi significantly increased the ECB's balance sheet from 2 trillion euros at the end of 2014 to 4.6 trillion euros at the end of May this year. Only here the Greek crisis of 2010 provoked an imbalance of economies of the Euro zone countries: the money shifted from Italy and Spain mainly to Germany. The surplus amounted to 1.3 trillion euro in March in Germany, Finland, Luxembourg and the Netherlands. The rest of the Euro zone maintained a net deficit of $ 1 trillion euro.

Trade War

This year, Donald Trump actively launched the program "America first", and he decided to start active operations with the normalization of the trade balance according to his vision. The White House intends to review current trade agreements to adjust trade with those partners where imports exceed exports therefore creating a negative trade balance. Despite the primary desire to introduce duties in order to reduce current trade deficit with China, the White House went on to raise duties almost without exception. The same with the imposed duties on imports of steel and aluminum from the EU countries - and this has become an aggravating factor for the euro.

Europe did not remain in debt and of course was guided by its rights within the WTO: it approved reciprocal duties on steel and aluminum in the United States. As a result, there is a weakening of the euro in relation to the US Dollar and a huge likelihood of moving capital from European Eurobonds to US treasuries. And this is a clear sign of a crisis in Europe.

We put a "tick" in the question "The crisis in the EU to be." By the way, an encouraging factor is that if the crisis in Europe is profitable for the US, then the strengthening of the US Dollar somewhat distorts the taken course of the game to lower the American currency. After all, it hinders the growth of exports. The latter is necessary to eliminate the trade deficit. So, we can safely assume that the short-term euro rate is going down.

Political crisis in Italy

Additionally, the euro was hit by a political crisis in Italy. Why is it so important for the currency? Because the EU simply does not have the means to save it. The growth of the Greek government bond yield to 11%, and the USD / EUR rate of 1.07, as well as the threat of loss of major creditors against the backdrop of Prime Minister's statements on external debt are still fresh in memory. Another consequence of the threat of Greek default was the outflow of capital from developing countries.

Greece took 3 years to overcome the crisis, it's been so long since the referendum against Europe and the agreement in Athens with creditors the same spring. Under this agreement, Greece is obliged to carry out a package of necessary reforms. On the way from default to reconciliation with the EU, there was a threat of Greece's withdrawal from the EU, the weakening of the euro and the launch of the "domino principle" for other PIGS countries (Portugal, Ireland, Greece and Spain – countries carrying large debt). Italy is not Greece: its economy is 10 times bigger, the public debt of 2.3 trillion euro is 7 times higher than that of Greece. Italy is one of the largest economies in the euro area and the ninth largest economy in the world. What will require more effort and the consequences of which can have a greater effect: the collapse or salvation of Italy? The question is whether its new government will lead to such a crisis, and if so, what will be the consequences?

By the way, a few words about the new government. Of course, in Italy they have become accustomed to changing government, but not to political upheavals. And the creation of coalition between the parties "Movement of Five Stars" and "League of the North" is a shock for the country, especially due to the fact that “Movement of Five Stars” are actively advocating a way out of the euro. It remains only to add that it is unlikely that the current political situation in Italy will add confidence to the rest of the EU countries. Let’s hope for the 2019 elections.

Migration Policy

Another “control shot" for Europe and a stumbling block for the European leaders appears to be the migration issue. The Merkel’s “open doors” policy in 2015 caused significant damage not only to Germany, but also to the transit countries, such as Austria and Italy. In that year, according to the German Federal Office for Migration and Refugees, 890,000 people entered the country with a request for asylum. In 2017, there were more than 200 thousand. Tightening of migration rules is actively supported by the leaders of Austria, Italy and the Minister of the Interior of Germany Horst Seehofer. Moreover, the latter actually went into conflict with Chancellor A. Merkel.

At the summit in Brussels on June 29, the leaders of the countries of the European Union reached an agreement on migration issues. Now, in the EU countries, new centers for migrants waiting to get admitted as refugees can only be created on a "voluntary basis”. The leaders of the EU countries agreed to strengthen external border control and increase funding for Turkey, Morocco and North Africa, who receive refugees. Actually the problem is temporarily settled, but the mutual understanding between the EU leaders is shattered.

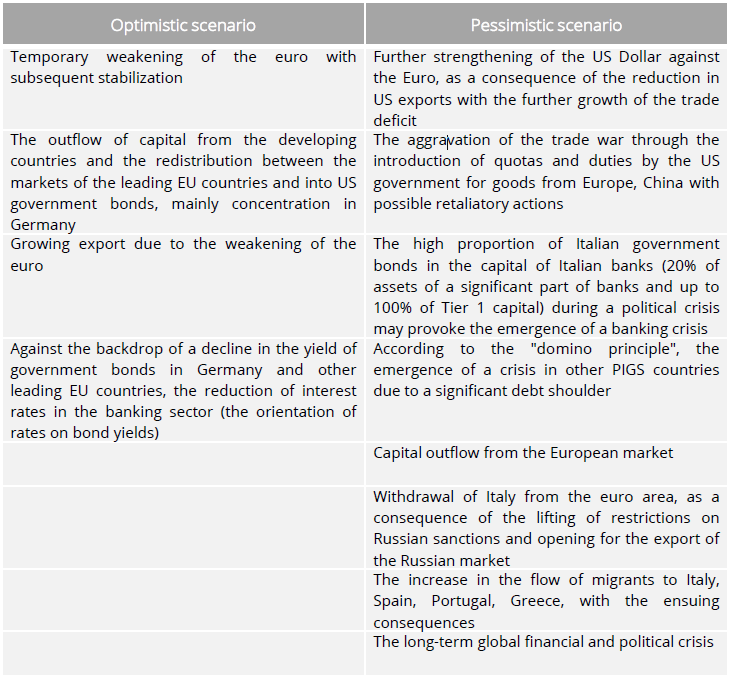

Furthermore, there is a split not only inside Europe, but also beyond its borders: such as obvious integration problems. The collapse of the nuclear deal with Iran and the destruction of the EU-US alliance will certainly damage the European economy and cause other problems, including the devaluation of the currencies of developing countries. Given the above factors, we can safely agree with numerous analysts: the crisis is really coming. What are the consequences of it? We believe in an optimistic outcome, but we also take into account the probability of a pessimistic course of events. A brief picture of the scenarios is given below.

The consequences of the crisis in Europe

Will Europe cope with this? Or is it not already 2008, but 2018? And the most exciting question: where is it more profitable to invest capital?

Obviously, in this situation there will be parties on both – loser and winner – sides. The one on the winner side are two countries with an export-oriented economy: Germany and France. In addition, there is also a movement of capital in their interests: in search of a "quiet harbor" investors from all over Europe have rushed to Germany and France. As a result, demand for government and corporate bonds of these countries has increased.

The course for stability, albeit with moderate steps, is observed in the US, accordingly, the financial assets of the US market are also particularly attractive to investors.

Quite absurd may seem to be the recommendation to pay attention to the Russian market, but as a result of the sanctions, Russia is behind the EU's bog and is less affected by its problems. Moreover, individual countries exiting the euro zone opens up new export opportunities for Russia.

In general, the crisis in the euro area has been developing for so long that the situation seems quite stable (although dramatic). So do not expect a quick solution to problems in Europe. We will not see the culmination so soon.

Lesja Shemet

Macte Invest, Financial analyst

Atgal