What should ABLV Bank's creditors expect?

While the State Administration hurries to decide on the further cooperation of banks with non-residents and shell companies, ABLV Bank and its creditors can only wait patiently for the decision of the FCMC to liquidate the bank without initiating an insolvency process. The key criterion for such a decision should be the ability to fully repay its loan obligations: in accordance with the legislation, the self-liquidation process is possible only if the credit institution can fully cover all its debt.

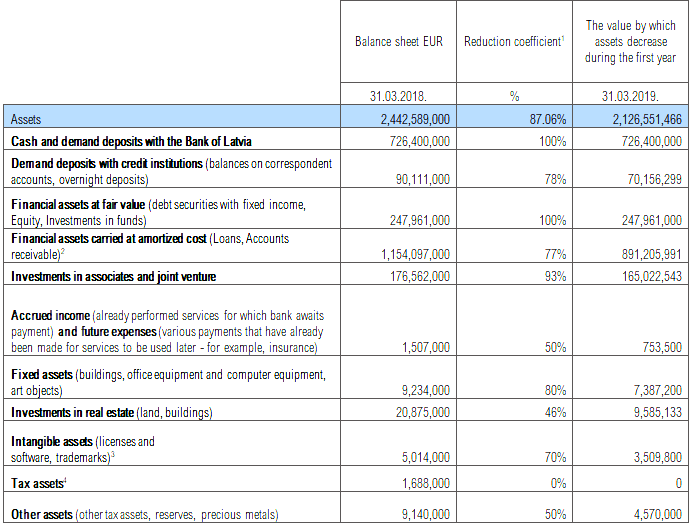

Currently, the FCMC is deciding on the state of the bank's assets and whether they will be sufficient to cover all of the bank's liabilities. The date of the initial decision was April 4, but the decision period was extended. In the meantime, we offer an opportunity to get acquainted with the status of the bank's assets and two possible scenarios in the process of liquidation of the bank - the process of self-liquidation and insolvency. Although Latvia does not have a historical example of self-liquidation, it is believed that such a result will be cheaper, more controlled and more advantageous for all stakeholders than the insolvency procedure. The first table shows the bank's assets by March 31, 2018, and the amount by which they could be reduced within one year based on past insolvency procedures of credit institutions.

1. The reduction coefficient for various asset positions is mainly taken from historical liquidation procedures of other financial institutions (TKB, Latvijas Krājbanka).

2. From examples of historical liquidation processes, it is clear that it is impossible to fully recover all loans. For example, during the first year of the TKB liquidation process, 77% of loans were recovered. If the depositor has taken a loan from ABLV Bank, it is reduced by the number of available deposit. Also, quite often credit portfolios are sold to other credit institutions at a reduced price, which may significantly differ from the book value.

3. Intangible assets can be sold for an amount much higher or lower than the book value, due to the complexity of valuation of intangible assets. For precaution, the applied sales ratio is 70%.

4. Tax assets are realized only during the following periods. When liquidated, tax assets cannot be realized, as the company ceases to exist.

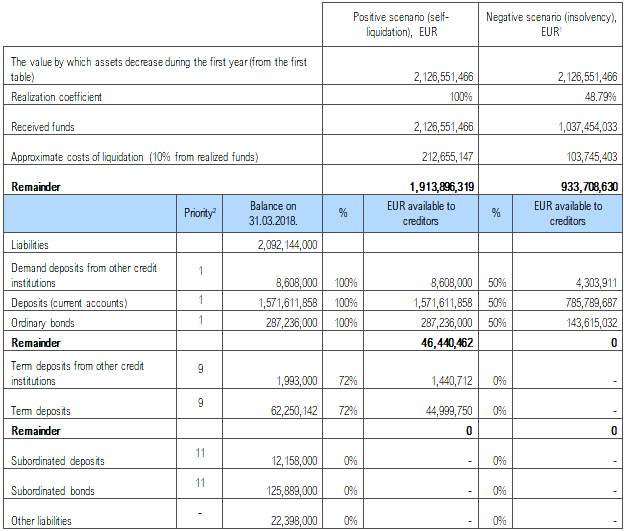

Not all of the amount by which the bank's assets will decrease in the liquidation process will be returned to the creditors. For example, during the first year of the TKB liquidation process, creditors received about 127 million EUR, which is only 44% of the amount by which the value of assets decreased in the balance sheet during the same period of time. The amount available to creditors largely depends on how the liquidator can realize the bank's assets.

Before starting to repay creditors, all costs for administering insolvency, including administrative salaries, are covered. At the moment, the government is trying to limit the remuneration of the liquidators, but previously the costs of liquidation amounted to approximately 10% of the funds returned.

Also, all depositors receive guaranteed deposits of up to 100,000 EUR from the bank itself or the Guaranteed Deposit Fund (this money has already been transferred to Citadele Bank and is being paid to depositors, so they are not included in the table of assets and liabilities). Further, creditors are entitled to a refund in the order described in the law.

Money is paid to creditors at a certain stage only after the creditors of the previous stages have fully received their funds. If the money is insufficient to cover one of the stages in full, the money is returned to the creditors in proportion to the initial investment.

Below are the balance sheet liabilities of ABLV Bank as of 31.03.2018 and their possible coverage in two scenarios - in the process of self-liquidation and in the process of insolvency.

1. An example of a negative scenario is the recent insolvency process of TKB. The realization ratio of 48.79% is calculated taking into account the value by which assets decreased during the first year on the TKB balance sheet and the amounts actually paid to the bank's creditors in the first year of insolvency.

2. Priority of payments in the process of insolvency is established in accordance with the law that provides 11 stages during which funds are returned to creditors. Some stages do not appear on the balance sheet of ABLV Bank or fall into other liabilities.

As mentioned before, self-liquidation of ABLV Bank can take place only if the bank can fully fulfil its obligations. According to calculations, ABLV Bank will be able to cover all its liabilities only if at least 87.06% of its assets are sold and realized (received funds) with a 100% coefficient; or 96.73% of assets are sold and realized with a 90% coefficient. It should be added that, in such a case, liquidators would have to significantly limit their spending, since only 1.67% of the returned funds, or 34.407.466 EUR, would be redirected for various insolvency expenditures (including salaries of liquidators).

Meanwhile, if ABLV Bank must pay about 10% for various insolvency processes, auctions and the administrator's salary, it will not be able to fulfil the main requirement - to fully pay off all obligations. But in the scenario of self-liquidation, the bank can negotiate costs and regulate the liquidation process, ensuring that the costs are well below 10% (which will not be possible during an insolvency procedure organized by the state).

07/05/2018

Santa Zvaigzne

Macte Invest, Senior Financial Analyst

Atgal